主要銘柄の値動きは下記の通り

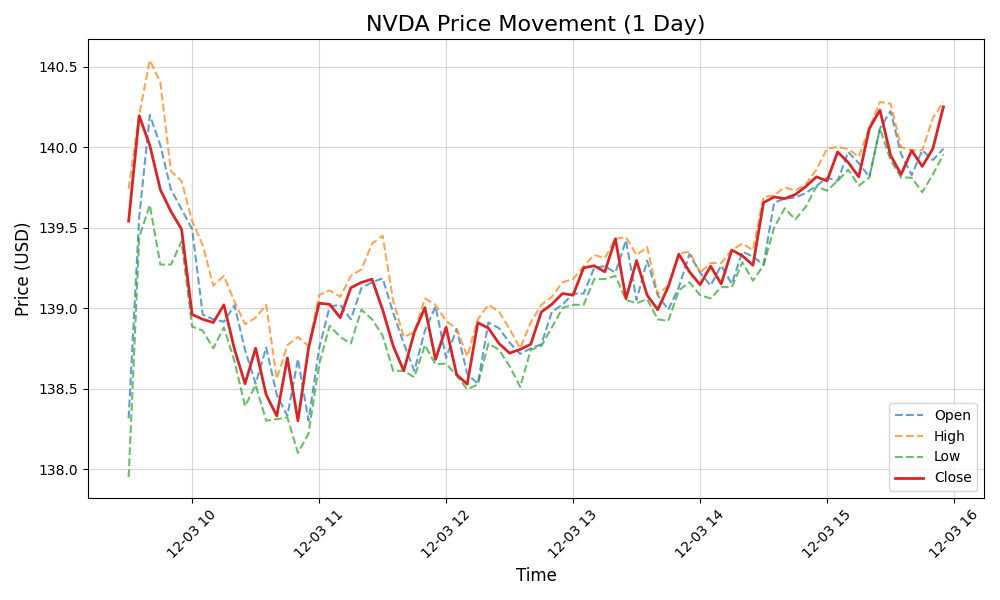

NVDA の株価推移

株価推移の要因

As an AI, I am unable to monitor real-time market developments or specific events occurring on a specific date. However, I can tell you generally what type of factors can influence NVDA’s (NVIDIA Corporation) stock price:

1. **Earnings Reports**: NVIDIA’s quarterly earnings reports can significantly influence its stock price. If earnings exceed analysts’ predictions, the stock price often goes up. If earnings are below expectations, the stock price can decrease.

2. **Product Announcements**: As a leading designer of graphics processing units, new product announcements or updates about product development have the potential to move NVIDIA’s stock.

3. **Market Trends**: Macro trends in the technology sector and the stock market in general can affect NVIDIA’s stock price.

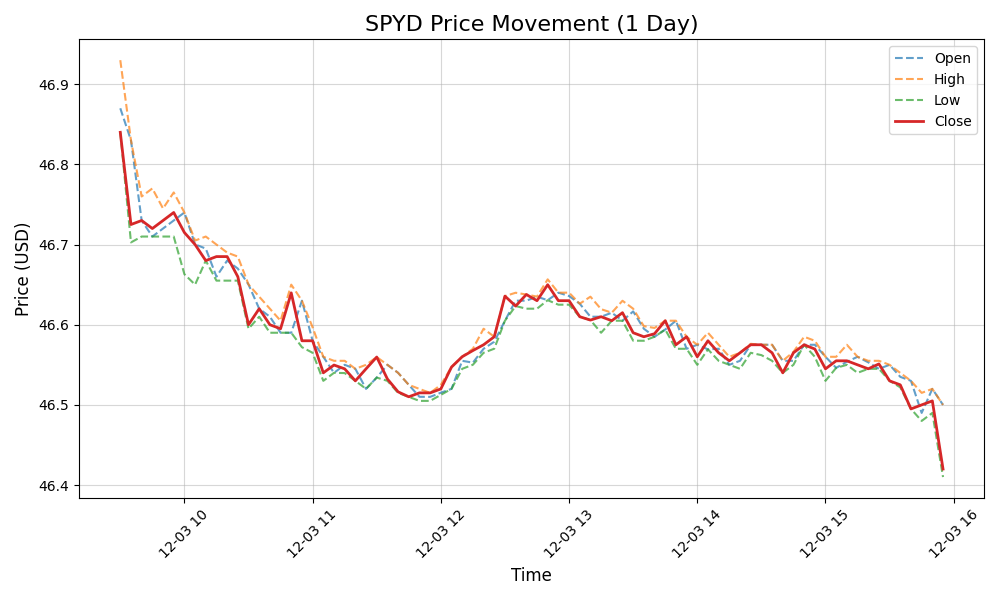

SPYD の株価推移

株価推移の要因

As an AI, I cannot provide real-time market updates or analysis. However, I can mention general factors that tend to affect the price of a financial asset such as SPYD or any other Exchange Traded Fund (ETF):

1. **Market Sentiment**: This encompasses the overall attitude of investors toward a particular asset or the market as a whole. Positive sentiment can lead to buying pressure and an uptick in prices, while negative sentiment can cause selling pressure and a drop in prices.

2. **Economic Indicators**: Factors such as inflation rates, interest rates, unemployment figures, GDP growth rates, etc. can significantly impact stock prices. For example, if the Federal Reserve increases interest rates, it could impose a higher borrowing cost that negatively

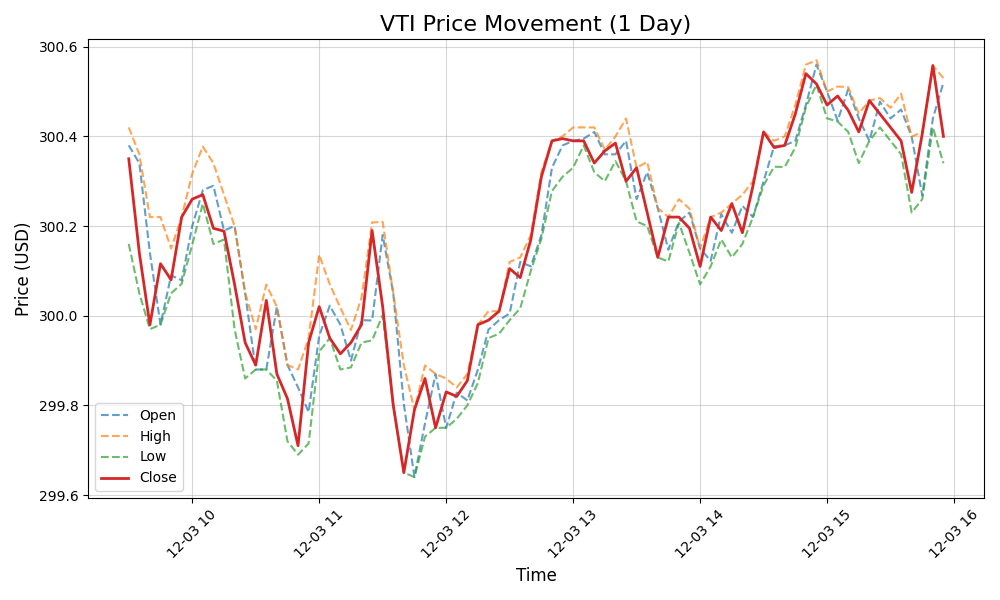

VTI の株価推移

株価推移の要因

As an AI, I don’t have real-time or daily updated data access, so I can’t provide a specific analysis of VTI’s stock price move for today. However, I can tell you that generally, stock prices like VTI, which is Vanguard’s Total Stock Market ETF, can be influenced by a number of factors. Here they are:

1. Market Conditions: Stock prices quite often move in sync with overall market trends. If the broader market is down, VTI would likely see a similar trend and vice versa.

2. Economic Indicators: Key economic data such as GDP growth, employment data, inflation, and consumer sentiment can impact stock prices. Positive economic news can push prices higher, while negative data can put a downward pressure